Protect Your Home With Tiq Home Insurance by Etiqa!

Living & Lifestyle5 minutes read

3215 views

3215 views

If you have crossed that enormous financial hurdle of securing money for your home renovation, whether via a loan or from your savings, congratulations! You now have your new home!

Purchasing and moving into a new home is just the beginning, and from then on, you have to do more to ensure your home remains in tip-top shape. This is especially so if an unexpected incident happens in your lovely home.

House fires. Flooding. Pest infestation. Electrical issues. Plumbing problems. Home security breaches.

These are just a few of a long list of things that could negatively affect your home sweet home. To alleviate these problems, you may have to break a lot of piggy banks. Repairs can be costly, so it does pay to have home insurance on hand in case of these incidents occurring in your home.

Basic insurance plans are good, but may be insufficient in covering severe damages. For example, the HDB Fire Insurance only covers the structure of your home in the original state it was built. It does not vouch for the inside of your home, renovation and belongings. With fire breakouts at home becoming more prevalent these days, this is rather troubling.

However, if you know where to look, you can get your hands on a comprehensive home insurance plan such as Tiq Home Insurance, which will take care of such home accidents, and a little bit more.

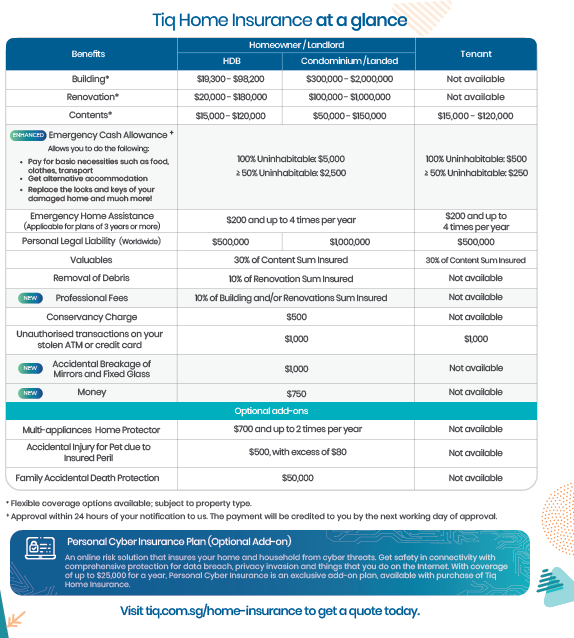

This service caters to homeowners or tenants of HDBs, condominiums or landed property who want to protect their building, renovation and home contents. It offers comprehensive yet flexible coverage with specially tailored benefits, so that homeowners can pick and choose plans that best protect their home and themselves.

Tiq Home Insurance is available online for quick and convenient purchase.

What Can You Get From Tiq Home Insurance?

By getting Tiq Home Insurance, your home and all that you love will be well-protected. Some benefits include:

- Emergency Cash Allowance: Up To to $5,000 to tide you through an emergency in the event your home is uninhabitable due to an insured peril such as a fire

- 24/7 Emergency Home Assistance that covers four common household problems: plumbing, electrical, pest infestation, and locksmith issues (Free for plans of 3 to 5 years). With coverage of up to $200 per event, up to 4 events per year!

- Professional Fees: 10% of building and/or renovations sum insured

- Accidental Breakage of Mirrors & Fixed Glass: Up to $1,000

- Money, in case of home burglary: Up to $750

- Choices between 1-Year, 3-Year & 5-Year Plans

- Plans as low as $28 per year

Image ©️ Etiqa Insurance/Tiq Home Insurance

As local artiste and Singapore Boy Hossan Leong puts it in these two advertisements, Tiq Home Insurance gives your home comprehensive coverage, be it for fires or any other unfortunate incidents.

Like he said here, imagine all that money you can save for your future coffee fixes. “Your home sure okay. Double confirm!”

Here’s a little promo to get you started: Enjoy 15% off and up to S$100 CapitaVouchers when you buy Tiq Home Insurance by 30 September 2019! Simply purchase Tiq Home Insurance here during the promotion period, and enter promotion code CAPTIQ in the promo coupon field.

Contact Etiqa Insurance to get a quote from Tiq Home Insurance here.

Hotline/Whatsapp: +65 6887 8777

Email: customer.service@etiqa.com.sg

Customer Care Centre: 16 Raffles Quay, Hong Leong Building, #01-04A, Singapore 048581

Request for quotes and we'll match you with a selection of Interior Designers!

Previous

You Must Read These 6 Tips on Kitchen Remodeling

Sign Up with Google

Sign Up with Google

.jpg)